The past week has been eventful for global markets, with significant economic data releases, shifts in trade policies, notable stock market movements, and evolving investor sentiment. This comprehensive overview delves into these developments, provides a preview of the upcoming economic calendar, and offers technical analyses of key financial instruments.

Key Economic Data Releases This Past Week

1. U.S. Employment Report (February 2025):

- Nonfarm Payrolls: The U.S. economy added 151,000 jobs in February, falling short of the anticipated 160,000. This marks a slowdown from previous months, indicating potential cooling in the labor market.

- Unemployment Rate: The unemployment rate edged up to 4.1% from 4.0% in January, suggesting a slight increase in joblessness.

- Average Hourly Earnings: Wage growth remained modest, with average hourly earnings rising to $35.93 from $35.83 in the prior month.

2. Eurozone Inflation (February 2025):

- Headline Inflation: Preliminary data indicated a year-over-year inflation rate of 2.3%, down from 2.5% in January, reflecting easing price pressures.

- Core Inflation: Core inflation, excluding volatile items like food and energy, stood at 2.6%, slightly below the previous month’s 2.7%.

3. U.S. ISM Manufacturing PMI (February 2025):

- The Institute for Supply Management’s Manufacturing Purchasing Managers’ Index declined to 50.1 from 50.9 in January, indicating a marginal expansion in manufacturing activity.

Economic Factors: Trade Policies and Tariffs

The trade landscape experienced notable shifts:

- U.S. Tariffs: The U.S. administration imposed 25% tariffs on imports from Canada and Mexico and increased duties on Chinese goods to 10%. These measures aim to address trade imbalances but have raised concerns about potential economic repercussions.

- Retaliatory Actions: Canada and Mexico announced reciprocal tariffs on U.S. products, escalating trade tensions and contributing to market volatility.

Stock Market Overview from the Week

Major U.S. stock indices experienced declines:

- Dow Jones Industrial Average (DJIA): Fell by 2.37%, closing at 42,579.08, amid trade concerns and mixed economic data.

- S&P 500: Declined by 3.10%, ending at 5,738.52, marking its steepest weekly loss since September 2024.

- Nasdaq Composite: Dropped 3.45%, closing at 18,069.26, as technology stocks faced significant selling pressure.

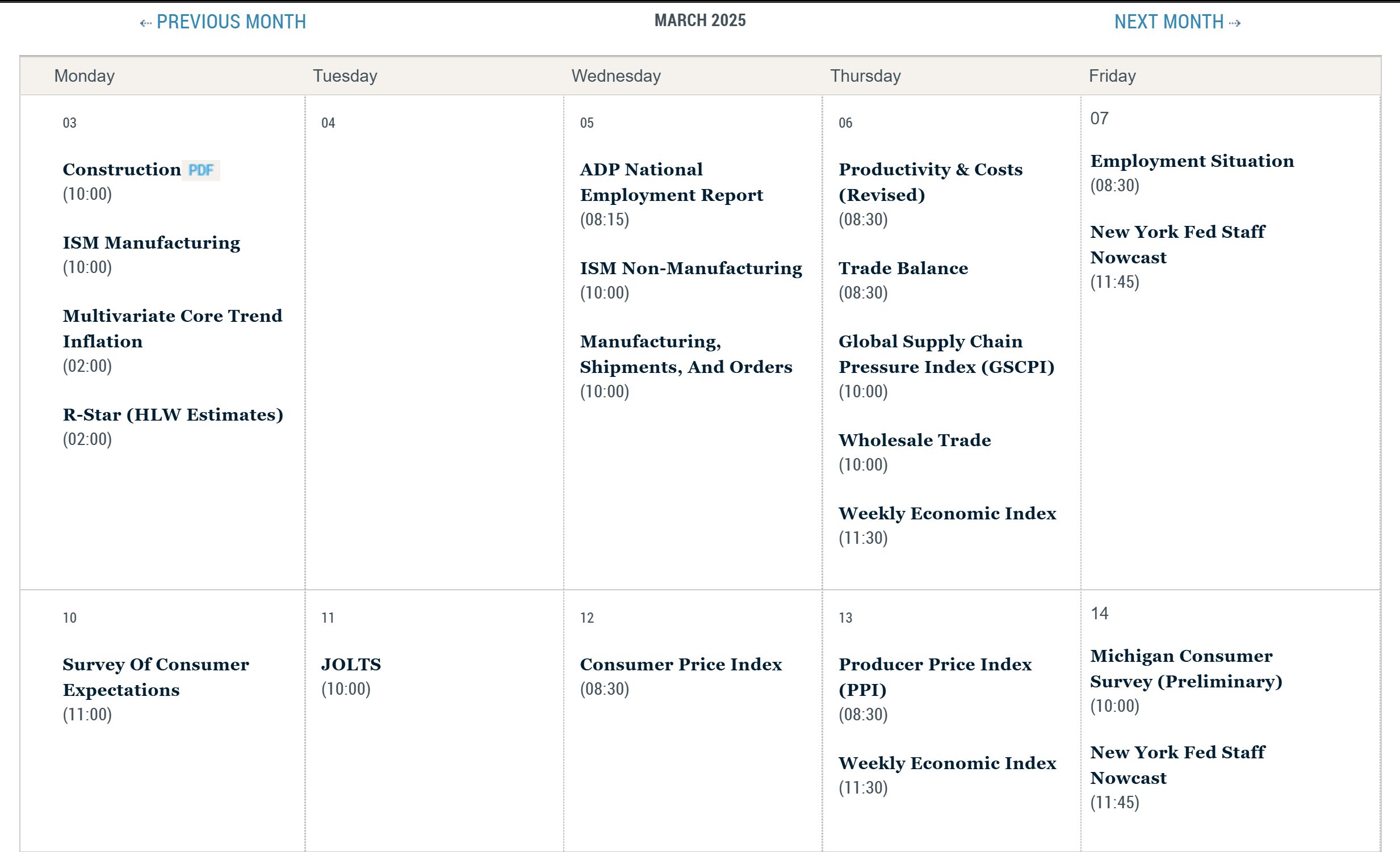

Upcoming Economic Calendar This Week

Key events scheduled for the week of March 10-14, 2025:

Wednesday, March 12:

- U.S. Consumer Price Index (CPI) for February: Provides insights into inflation trends.

- Adobe Earnings Report: Investors will assess performance and outlook.

Thursday, March 13:

- U.S. Producer Price Index (PPI) for February: Offers a view of wholesale inflation.

- U.S. Retail Sales for February: Indicates consumer spending trends.

Friday, March 14:

- University of Michigan’s Consumer Sentiment Index (March Preliminary): Reflects consumer confidence levels.

Market Sentiment

Investor sentiment has been influenced by:

- Trade Uncertainties: Escalating tariffs have heightened fears of a global trade war, leading to risk aversion.

- Economic Data: Mixed indicators, such as slowing job growth and modest wage increases, have added to market apprehensions.

- Monetary Policy Speculations: Anticipation of potential interest rate cuts by central banks has introduced additional uncertainty.

Key Financial Instruments: Fundamental and Technical Analysis

1. S&P 500 (SPX):

- Fundamental Overview: The S&P 500 experienced a 3.10% decline over the past week, primarily due to escalating trade tensions and softer economic data, including slower job growth and modest wage increases.

- Technical Analysis:

- Support Level: The index is approaching a critical support zone between 5,400 and 5,500, which has historically acted as a buffer against further declines.

- Resistance Level: Immediate resistance is observed around the 5,900 mark.

- Indicators: The Relative Strength Index (RSI) is nearing oversold territory, suggesting potential for a short-term rebound. However, the Moving Average Convergence Divergence (MACD) indicates diminishing upward momentum, warranting caution.

2. Nasdaq 100 (NDX):

- Fundamental Overview: The tech-heavy Nasdaq 100 declined by 3.45% this week, with technology stocks under pressure due to trade uncertainties and concerns over valuations.

- Technical Analysis:

- Support Level: The index is testing support at the 18,000 level, a psychological threshold that, if breached, could lead to further downside.

- Resistance Level: Resistance is identified near 18,500.

- Indicators: The RSI is approaching oversold conditions, indicating potential for a technical bounce. However, the MACD has turned negative, reflecting bearish momentum.

3. Dow Jones Industrial Average (DJIA):

- Fundamental Overview: The DJIA declined by 2.37% over the past week, influenced by trade tensions and mixed economic indicators.

- Technical Analysis:

- Support Level: The index is approaching support at 42,400, a level that has previously acted as a barrier against further declines.

- Resistance Level: Immediate resistance is observed around 43,100.

- Indicators: The Relative Strength Index (RSI) is nearing oversold territory, suggesting potential for a short-term rebound. However, the Moving Average Convergence Divergence (MACD) indicates diminishing upward momentum, warranting caution.

4. Gold (XAU/USD):

- Fundamental Overview: Gold prices have risen amid increased demand for safe-haven assets, driven by global economic uncertainties and trade tensions.

- Technical Analysis:

- Support Level: Strong support is present around the $1,900 mark, which has historically acted as a floor for prices.

- Resistance Level: The next significant resistance is at $2,000.

- Indicators: The RSI is in neutral territory, providing room for further price movements. The MACD shows a bullish crossover, indicating potential upward momentum.

5. U.S. Dollar Index (DXY):

- Fundamental Overview: The U.S. Dollar Index has experienced fluctuations due to trade policy changes and varying economic data.

- Technical Analysis:

- Support Level: The index finds support at 100.00, a psychological level that could prevent further declines.

- Resistance Level: Resistance is identified near 102.50.

- Indicators: The RSI is approaching oversold conditions, suggesting a potential reversal. The MACD is negative, reflecting current

Five Biggest Stock Moves from the Week

The past week witnessed significant movements among blue-chip and technology stocks, influenced by earnings reports, industry developments, and broader market dynamics.

1. Broadcom Inc. (AVGO):

- Performance: Shares surged by up to 18% in after-hours trading following the company’s earnings release.

- Catalyst: Broadcom reported first-quarter revenue of $14.9 billion, surpassing Wall Street expectations. The company also highlighted a promising outlook on artificial intelligence (AI), attributing strong performance to investments in custom AI chips by major tech firms like Amazon, Microsoft, Google, and Meta.

2. Hewlett Packard Enterprise (HPE):

- Performance: The stock led losses in the S&P 500, experiencing a significant decline.investopedia.com

- Catalyst: Hewlett Packard Enterprise issued a disappointing outlook and announced layoffs, raising concerns about future growth prospects.

3. Costco Wholesale Corporation (COST):

- Performance: Shares fell after the company reported underwhelming profits.

- Catalyst: Economic uncertainty and challenges in maintaining profit margins contributed to investor apprehension.

4. Walgreens Boots Alliance (WBA):

- Performance: The stock surged following acquisition news.

- Catalyst: Sycamore Partners announced a $10 billion acquisition of Walgreens Boots Alliance, boosting investor confidence.

5. Gap Inc. (GPS):

- Performance: Shares experienced gains driven by strong holiday earnings.

- Catalyst: A successful turnaround plan and robust holiday sales performance contributed to positive investor sentiment.

Earnings Calendar

The upcoming week of March 10-14, 2025, features several notable earnings reports from major companies across various sectors. Below is a schedule of selected earnings releases, including the expected reporting times:

Monday, March 10:

- Oracle Corporation (ORCL): Reports after market close. Investors anticipate insights into the company’s cloud services performance and any updates on its artificial intelligence initiatives.

Wednesday, March 12:

- Adobe Inc. (ADBE): Reports after market close. Focus will be on the company’s progress in integrating AI into its product suite and its subscription revenue growth.

Thursday, March 13:

- Dollar General Corporation (DG): Reports before market open. Investors will look for updates on consumer spending trends, especially in the context of economic uncertainties.

- Ulta Beauty Inc. (ULTA): Reports after market close. Attention will be on same-store sales growth and e-commerce performance.

- Casey’s General Stores Inc. (CASY): Reports after market close. Analysts will be interested in fuel sales and in-store merchandise performance.

- Kohl’s Corporation (KSS): Reports before market open. Focus will be on inventory management and strategies to boost foot traffic.

Friday, March 14:

- CoreWeave: While not an earnings report, CoreWeave, a cloud computing firm backed by Nvidia, is expected to go public this week, potentially marking one of the largest IPOs in recent years.

Consumer Watch: Gasoline Prices, Mortgage Rates, and More

Staying informed about economic indicators is crucial for consumers making financial decisions. Here’s an overview of current mortgage rates, gasoline prices, and other factors affecting daily life.

Gasoline Prices:

- Current Averages: The national average for regular gasoline is approximately $3.09 per gallon as of March 6, 2025.

- Recent Trends: Gasoline prices have remained relatively stable, with a slight decrease of one cent from the previous week, attributed in part to softer oil prices. gasprices.aaa.com

- Future Outlook: Newly imposed tariffs on imports from Canada, Mexico, and China are anticipated to increase gasoline prices. In the Northeast, prices could rise by 20 to 40 cents per gallon due to reliance on Canadian fuels. The Midwest may see increases of 10 to 15 cents per gallon.

Mortgage Rates:

- Current Averages: As of March 7, 2025, the average 30-year fixed-rate mortgage stands at 6.841%, while the 15-year fixed-rate mortgage averages 6.209%. mortgagenewsdaily.com+2money.com+2themortgagereports.com+2

- Recent Trends: Mortgage rates have seen a slight decline recently. For instance, the 30-year fixed-rate mortgage experienced the largest weekly drop since mid-September, enhancing purchasing power for prospective homebuyers.

- Future Outlook: Despite the recent dip, mortgage rates are expected to remain elevated throughout 2025, potentially averaging around 6.5% early in the year and decreasing slightly by year’s end. This sustained high rate environment may continue to challenge affordability for many homebuyers.

Cattle Prices:

- Current Averages: As of early March 2025, feeder cattle futures for March delivery are trading around 274.025 cents per pound.

- Recent Trends: The U.S. cattle herd has declined to its lowest numbers since 1951, with the latest USDA data showing 86.7 million head of cattle and calves as of January 1, 2025. This reduction has contributed to higher cattle prices. chron.com

- Future Outlook: Tight supplies and strong demand could push cattle prices to even higher highs in 2025. However, uncertainty is infusing more risk and volatility into the markets.

Additional Consumer Considerations:

- Product Prices: The recent tariffs are expected to raise prices on various goods, including produce, electronics, and toys. For example, Mexican produce, crucial during winter months, may see immediate price hikes.

- Energy Costs: Beyond gasoline, the tariffs could lead to higher prices for natural gas and electricity, especially in regions heavily reliant on Canadian energy imports.

Conclusion: Key Takeaways

- Trade Policies and Tariffs: The imposition of new tariffs by the U.S. administration and subsequent retaliatory measures have heightened fears of a global trade war, contributing to market volatility.

- Economic Indicators: Mixed economic data, including slower job growth and modest wage increases, suggest potential cooling in the labor market, influencing investor sentiment.

- Stock Market Performance: Major indices, including the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, experienced declines, reflecting investor concerns over economic uncertainties and trade tensions.

- Corporate Earnings: Earnings reports from key companies like Broadcom and Hewlett Packard Enterprise have significantly impacted stock movements, underscoring the importance of corporate performance in market dynamics.

- Investor Strategies: Increased market volatility has led investors to adopt more sophisticated trading strategies, such as shorter-duration options and after-hours trading, to manage risk and capitalize on market movements.

At Tax-Free Wealth Solutions, our mission is to help individuals and families maximize wealth, minimize taxes, and reduce financial risk. While staying informed about economic trends is essential for making sound financial decisions, you shouldn’t have to navigate the complexities of the market alone. Our goal is to remove the stress and worry that comes with economic uncertainty, ensuring that your financial future remains secure—no matter what happens in the economy.

If you’re looking for a personalized financial strategy that protects your wealth from market volatility, book an appointment with us today and let us help you create a plan that aligns with your goals.

Want to make better financial decisions? Check out our other recent posts: